Property Blues? - Not In Bulgaria

Everybody knows that property prices in the UK are heading south and that the spectre of negative equity is once again raising its head. Not so in Bulgaria, apparently.

Last week, Bulgarian Property Developments was shouting from the Sredna Gora mountain tops after it managed to sell its logistics park in the Black Sea town of Varna for Ђ15m (Ј11.9m), the valuation given to it by Colliers last Dec-ember.

That is important, says its chief executive, Ivo Hesmondhalgh, not only because it helps bump up the group's cash position, but also because it goes some way to proving to investors that the group's net asset value is sound.

Mr Hesmondhalgh was so chuffed, in fact, that he has decided to buy more shares in the group, a lucrative move since last Tuesday when BPD announced a 19p dividend. The shares closed on Friday at 51.25p, and investors still have until 11 July to buy before the stock goes ex-dividend, effectively meaning that buyers can pick up shares for about 32p.

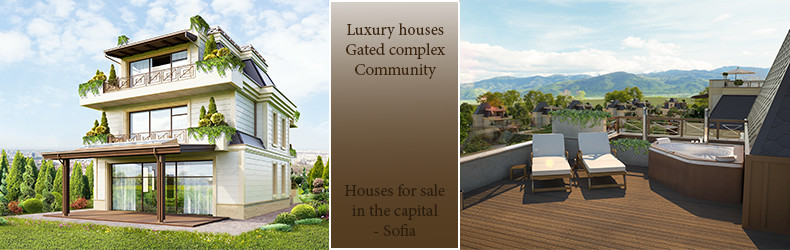

Analysts say that the group trades at a significant discount and that the stock actually should be worth 56p given the net asset value. Moreover, if the group's application to increase density in its major site in Sofia gets approval, this figure will rise to 71p.

Mr Hesmondhalgh only managed to get three hours sleep last Thursday night, after a disturbance at Sofia airport, from where he was travelling to his home in Barcelona, caused his flight to be cancelled. He should sleep more easily on the night of 17 July after the group pays the dividend.